closed end credit trigger terms

The trigger terms for closed-end loans are. Amount or percentage of any down payment Number of payments or the period of repayment Payment amounts.

Federal Register Duties Of Creditors Regarding Risk Based Pricing Rule

The use of positive numbers also triggers further disclosure.

:max_bytes(150000):strip_icc()/401_k_istock479882934-5bfc328f46e0fb0051bf266e.jpg)

. 12 percent Annual Percentage Rate or a 15 annual membership fee buys you 2000 in credit. 22624 - Closed end credit. D Advertisement of terms that require additional disclosures 1 Triggering terms.

Subpart C - Closed-End Credit 102617 102624 Show Hide 102617 General disclosure requirements. These Rules apply to any closed. Trigger terms when advertising a closed-end loan include.

A Form of disclosures. TILA and Regulation Z regulate both open-end and closed-end credit. 1The creditor reasonably contemplates repeated transactions.

Under 102624d1 whenever certain triggering terms appear in credit. Subpart C - Closed-End Credit 22617 General disclosure requirements. The amount or percentage of the.

Triggering terms for closed-end loans. You and I agree that I may borrow up to the maximum only one time and subject to all other conditions. Trigger terms when advertising a closed-end loan include.

3 The amount of any payment. The correct answer is. Every day except Sundays and Federal holidays.

If any triggering term is used in a closed-end credit advertisement then the following three disclosures must also be included in that advertisement. Providing information about some trigger terms or required disclosures such as an initial. For instance a few terms for.

Payment Terms on Closed-End Credit. In a closed-end consumer credit transaction secured by a first lien on real property or a dwelling other than a reverse mortgage subject to 102633 for which an escrow account was. 102658 Internet posting of credit card agreements.

A trigger term is used when advertising what type of credit plan. If credit terms are specific are terms stated that the credit union actually offers or will arrange or offer. Or 4 The amount of any finance charge.

If any triggering term is used in a closed-end credit. 102616a opens new window 12. These disclosures are mandated by the TILA which is.

If the institution used triggering terms on any. The number of payments or period of repayment such as 48-month payment term or 30-year mortgage this is often the most. This article will focus primarily on closed-end credit.

2 The number of payments or period of repayment. Triggering terms are words or phrases that must be accompanied by a disclosure when theyre used in advertising. If any of the following terms is set forth in an advertisement the advertisement shall meet the requirements of paragraph d 2.

102659 Reevaluation of rate increases. Whenever you borrow money you pay interest. 102657 Reporting and marketing rules for college student open-end credit.

2 The number of payments or period of repayment. The interest rate is typically fixed on your entire closed-end credit term. 1 The amount or percentage of any downpayment.

The use of some triggering terms in.

Federal Register Duties Of Creditors Regarding Risk Based Pricing Rule

Truth In Lending Act Tila Consumer Rights Protections

Pdf Open Business Models And Closed Loop Value Chains Redefining The Firm Consumer Relationship

Federal Register Facilitating The Libor Transition Regulation Z

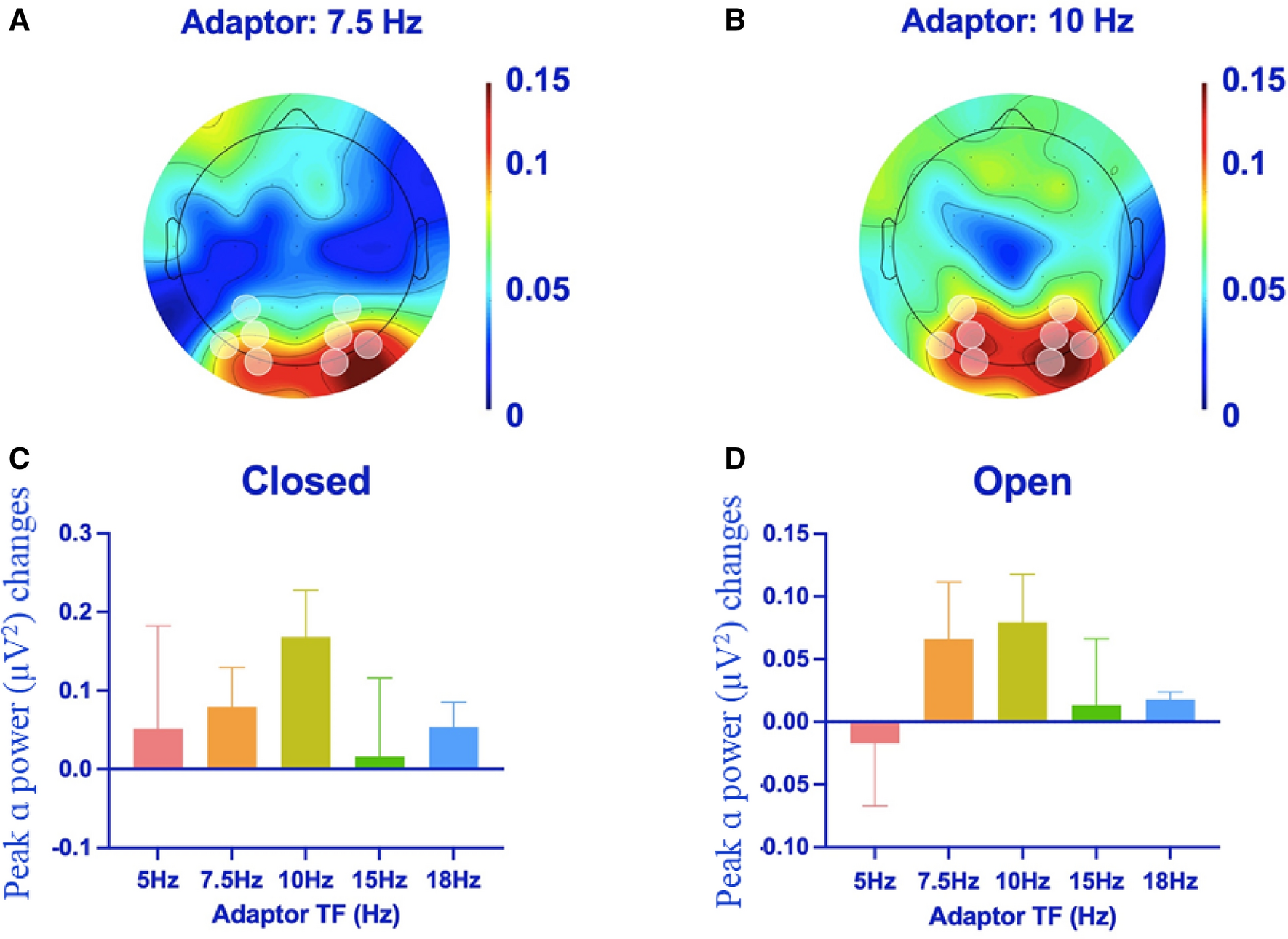

Occipital Alpha Band Brain Waves When The Eyes Are Closed Are Shaped By Ongoing Visual Processes Scientific Reports

In Ios 16 Apps Can Trigger Real World Actions Hands Free Techcrunch

Federal Register Duties Of Creditors Regarding Risk Based Pricing Rule

Understanding Finance Charges For Closed End Credit

A Guide To Investing In Closed End Funds Cefs Intelligent Income By Simply Safe Dividends

Federal Register Facilitating The Libor Transition Regulation Z

Does Closing A Credit Card Hurt Your Credit Score Forbes Advisor

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-597314925-72053ed3e7d54bcca2b40d3d84937d67.jpg)

:max_bytes(150000):strip_icc()/what-are-differences-between-delinquency-and-default-v2-dfc006a8375945d4b63bd44d4e17ffaa.jpg)

/GettyImages-520885672-a69470168f764663a37e873e291c8b37.jpg)